SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the registrant þ

Filed by a Party other than the registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement | |||

| ¨ | Confidential, for Use of the Commission Only (aspermitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive proxy statement | |||

| ¨ | Definitive additional materials | |||

| ¨ | Soliciting material pursuant to Rule 14a-12 | |||

BELDEN INC. | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of filing fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1)

| Title of each class of securities to which transaction applies:

| |||

(2)

|

Aggregate number of securities to which transaction applies:

| |||

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

(4)

|

Proposed maximum aggregate value of transaction:

| |||

(5)

| Total fee paid:

| |||

¨

|

Fee paid previously with preliminary materials.

| |||

¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

(1)

| Amount previously paid:

| |||

(2)

|

Form, schedule or registration statement no.:

| |||

(3)

|

Filing party:

| |||

(4)

|

Date filed:

| |||

April 15, 20132014

Dear Stockholder:

I am pleased to invite you to our 20132014 Annual Stockholders’ Meeting. We will hold the meeting at 11 a.m.12:30 p.m. central time on Thursday,Wednesday, May 30, 201328, 2014 at the SaintFour Seasons Hotel St. Louis, Club (16Mississippi Room, 8th Floor), Pierre Laclede Center, 7701 Forsyth Boulevard,Floor at 999 North 2nd Street, St. Louis, Missouri.

Consistent with past practice, we are pleased to be taking advantage of the U.S. Securities and Exchange Commission rule allowing companies to furnish proxy materials to their stockholders primarily over the Internet. We believe that this e-proxy process has expedited stockholders’ receipt of proxy materials, lowered the associated costs, and conserved natural resources.

On April 15, 2013,2014, we began mailing our stockholders a notice containing instructions on how to access our 20132014 Proxy Statement and 20122013 Annual Report and vote online. The notice also included instructions on how to receive a paper copy of your annual meeting materials, including the notice of annual meeting, proxy statement, and proxy card. If you received your annual meeting materials by mail, the notice of annual meeting, proxy statement, and proxy card from our Board of Directors were enclosed. If you received your annual meeting materials via e-mail, the e-mail contained voting instructions and links to the annual report and the proxy statement on the Internet, which are both available athttp://investor.belden.com/financialDocuments.cfm.

The agenda for this year’s annual meeting consists of the following items:

Agenda Item | Board Recommendation | |

1. Election of the Nine Directors Nominated by the Company’s Board of Directors | FOR | |

2. Ratification of the Appointment of Ernst & Young as the Company’s Independent Registered Public Accounting Firm for | FOR | |

3. Advisory Vote on Executive Compensation | ||

| FOR |

Please refer to the proxy statement for detailed information on the proposals and the annual meeting. Your participation is appreciated.

Sincerely,

John Stroup

President and Chief Executive Officer

BELDEN INC.

7733 Forsyth1 North Brentwood Boulevard,

Suite 80015th Floor

St. Louis, Missouri 63105

314-854-8000

NOTICE OF 20132014 ANNUAL STOCKHOLDERS’ MEETING

| TIME & DATE | ||

| PLACE | ||

| AGENDA | 1. To elect the nine directors nominated by the Company’s Board of Directors, each for a term of one year | |

2. To ratify the appointment of Ernst & Young as the Company’s independent registered public accounting firm for | ||

3. To hold an advisory vote on executive compensation | ||

4. | ||

| ||

| WHO CAN VOTE | You are entitled to vote if you were a stockholder at the close of business on | |

| FINANCIAL STATEMENTS | The Company’s | |

| VOTING | Please vote as soon as possible to record your vote promptly, even if you plan to attend the annual meeting. You have three options for submitting your vote before the annual meeting:

• Internet

• Phone (if you request a full delivery of the proxy materials)

• Mail (if you request a full delivery of the proxy materials) | |

By Authorization of the Board of Directors,

Kevin Bloomfield

Senior Vice President, Secretary and General Counsel

St. Louis, Missouri

April 15, 20132014

PROXY STATEMENT FOR THE

20132014 ANNUAL MEETING OF STOCKHOLDERS OF

BELDEN INC.

To be held on Thursday,Wednesday, May 30, 201328, 2014

| 1 | ||||

| 1 | ||||

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING | 2 | |||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

What is the difference between holding shares as a stockholder of record and as a beneficial owner? | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

What happens if additional proposals are presented at the meeting? | 4 | |||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

Related Party Transactions and Compensation Committee Interlocks | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

Fees to Independent Registered Public Accountants for | 14 | |||

| 14 | ||||

| Belden Inc. | Pagei |

EQUITY COMPENSATION PLAN INFORMATION ON DECEMBER 31, | ||||

Beneficial Ownership Table of Directors, Nominees and Executive Officers | ||||

Beneficial Ownership Table of Stockholders Owning More Than Five Percent | ||||

| I-1 |

| Page ii | Belden Inc. |

Internet Availability of Proxy Materials

Under rules of the United States Securities and Exchange Commission (SEC), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On April 15, 2013,2014, we began mailing to our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability of Proxy Materials also instructs you on how to access your proxy card to vote through the Internet or by telephone.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the annual meeting, and help conserve natural resources. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

QUESTIONS

| For questions | ||

| Regarding: | Contact: | |

| Annual meeting or | Belden Investor Relations, 314-854-8054 | |

| Executive Compensation Questions | ||

| Stock ownership | American Stock Transfer & Trust Company | |

| (Stockholders of Record) | http://www.amstock.com | |

| 800-937-5449 (within the U.S. and Canada) | ||

| 718-921-8124 (outside the U.S. and Canada) | ||

| Stock ownership | Contact your broker, bank or other nominee | |

| (Beneficial Owners) | ||

| Voting | Belden Corporate Secretary, 314-854-8035 | |

| Belden Inc. | Page 1 |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | Why am I receiving these materials? |

| A: | The Board of Directors (the “Board”) of Belden Inc. (sometimes referred to as the “Company” or “Belden”) is providing these proxy materials to you in connection with the solicitation of proxies by Belden on behalf of the Board for the |

| Q: | Why am I being asked to review materials online? |

| A: | Under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our stockholders on the Internet, rather than mailing printed copies of those materials to each stockholder. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy materials on the Internet. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. We began mailing the Notice of Internet Availability of Proxy Materials to stockholders on April 15, |

| Q: | Who is qualified to vote? |

| A: | You are qualified to receive notice of and to vote at the annual meeting if you owned shares of common stock of the Company at the close of business on our record date of April 4, |

| Q: | What information is available for review? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the meeting, the voting process, the compensation of directors and our most highly paid officers, and certain other required information. Our |

| Q: | What matters will be voted on at the meeting? |

| A: | Three matters will be voted on at the meeting: |

| (1) | the election of the nine directors nominated by the Board, each for a term of one year; |

| (2) | the ratification of the appointment of Ernst & Young as the Company’s independent registered public accountant for 2013; and |

| (3) | an advisory vote on executive |

| Q: | What are Belden’s voting recommendations? |

| A: | Our Board of Directors recommends that you vote your shares: |

| (1) | FOR the Company’s slate of directors; |

| (2) | FOR the ratification of Ernst & Young; and |

| (3) | FOR the approval of the Company’s executive |

| Q: | What shares owned by me can be voted? |

| A: | All shares owned by you as of April 4, |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Some Belden stockholders hold their shares through a stock broker, bank, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

| Page 2 | Belden Inc. 2014 Proxy Statement |

Stockholder of Record

If your shares are registered directly in your name with Belden’s transfer agent, American Stock Transfer & Trust Company, you are considered (with respect to those shares) the stockholder of record and the Notice of Internet Availability of Proxy Materials is being sent directly to you by Belden. As thestockholder of record, you have the right to grant your voting proxy directly to Belden or to vote in person at the meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered thebeneficial owner of shares held in “street name” (that is, the name of your stock broker, bank, or other nominee) and the Notice of Internet Availability of Proxy Materials is being forwarded to you by your broker or nominee who is considered, with respect to those shares, thestockholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the meeting. However, since you are not thestockholder of record, you may not vote these shares in person at the meeting.

| Q: | How can I vote my shares in person at the meeting? |

| A: | Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to do so, please bring proof of identification. |

Even if you plan to attend the annual meeting, we recommend that you also submit your proxy as described below so that your vote will be counted if you decide later not to attend the meeting.

| Q: | How can I vote my shares without attending the meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. You will be able to do this over the Internet by following the instructions on your Notice of Internet Availability of Proxy Materials. If you request a full delivery of the |

| proxy materials, a proxy card will be included that will contain instructions on how to vote by telephone or mail in addition to the Internet. |

| Q: | Can I change my vote? |

| A: | You may change your proxy or voting instructions at any time prior to the vote at the annual meeting. For shares held directly in your name, you may accomplish this by granting a new proxy or by attending the annual meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee. |

| Q: | What class of shares is entitled to be voted? |

| A: | Each share of our common stock outstanding as of the close of business on April 4, |

| Q: | What is the quorum requirement for the meeting? |

| A: | The quorum requirement for holding the meeting and transacting business is a majority of the outstanding shares entitled to vote. The shares may be present in person or represented by proxy at the meeting. Both abstentions and withheld votes are counted as present for the purpose of determining the presence of a quorum for the meeting. |

| Belden Inc. | Page 3 |

| Q: | What are the voting requirements to approve the proposals and how are votes withheld, abstentions and broker non-votes treated? |

| A: | The following table describes the voting requirements and treatment of votes withheld, abstentions, and broker non-votes for each proposal: |

| Proposal | Voting Requirement | Tabulation Treatment | ||||

| Votes Withheld/Abstentions | Broker Non-Votes | |||||

| Election of Directors | Plurality of votes cast to elect each director | Present for quorum purposes; treated as a vote against the director(s) for purposes of calculating approval percentage | Not present for quorum purposes; brokers do not have discretion to vote non-votes in favor of directors | |||

| Ratification of Ernst & Young | No requirement; not binding on company | The Board of Directors will consider the number of abstentions in its analysis of the results of the advisory vote | Count as present for quorum purposes; brokers have discretion to vote non-votes in favor of ratification | |||

Advisory vote on executive compensation | No requirement; not binding on company | The Board of Directors will consider the number of abstentions in its analysis of the results of the advisory vote | Not present for quorum purposes; brokers do not have discretion to vote non-votes in favor of

| |||

|

|

|

compensation matters | |||

| Q: | Where can I find the voting results of the meeting? |

| A: | We will announce preliminary voting results at the meeting and publish final results in a report on Form 8-K within four business days of the date on which our meeting ends. |

| Q: | What happens if additional proposals are presented at the meeting? |

| A: | Other than the proposals described in this proxy statement, we do not expect any matters to be presented for a vote at the annual meeting. If you grant a proxy, the persons named as proxy holders, Kevin L. Bloomfield, the Company’s Secretary, |

| vote your proxy for such other candidate or candidates as may be nominated by the Board. |

| Q: | Who will count the votes? |

| A: | A representative of Broadridge Financial Solutions, Inc. will tabulate the votes and will act as the inspector of election. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Belden or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by our Board. Occasionally, stockholders provide written comments on their proxy cards, which are then forwarded to Belden management. |

| Page 4 | Belden Inc. |

| Q: | Who will bear the cost of soliciting votes for the meeting? |

| A: | Belden has retained Phoenix Advisory Partners to act as proxy solicitor for the annual meeting and to provide other advisory services throughout the year. Belden will bear the cost of this arrangement, which amounts to $8,000 annually. Upon request, the Company will reimburse brokers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of shares of the Company’s common stock. |

| Belden Inc. | Page 5 |

The Belden Board has nineten members and four standing committees: Audit, Compensation, Finance and Nominating and Corporate Governance. The Board had tensix meetings during 2012; six2013; two of which were telephonic. All directors attended 75% or more of the Board meetings and the Board committee meetings on which they served. The maximum number of directors authorized under the Company’s bylaws is nine.ten. Mr. Yoost will not stand for reappointment to the Board, and following the Annual Meeting, he will retire from the Board. The Board and the Company thank Mr. Yoost for his significant contributions to Belden during his tenure.

| Name of Director | Audit | Compensation | Finance | Nominating and Corporate Governance | Audit | Compensation | Finance | Nominating and Corporate Governance | ||||||||

David Aldrich | p | p | ||||||||||||||

Lance C. Balk | p* | p | p* | p | ||||||||||||

Steven W. Berglund | p | |||||||||||||||

Judy L. Brown | p | p | p | p | ||||||||||||

Bryan C. Cressey | p | p | p | p | ||||||||||||

Glenn Kalnasy | p* | p* | ||||||||||||||

George Minnich | p* | p* | ||||||||||||||

John M. Monter | p | p* | p | p* | ||||||||||||

John Stroup | ||||||||||||||||

Dean Yoost | p | p | ||||||||||||||

Meetings held in 2012 | 9 | 6 | 8 | 4 | ||||||||||||

Meetings held in 2013 | 11 | 6 | 8 | 4 | ||||||||||||

p | Committee member | |

| * | Chair |

At its regular meeting in March 2013,2014, the Board determined that each of the non-employee directors seeking reappointment meets the independence requirements of the NYSE listing standards. As part of this process, the Board determined that each such member had no material relationship with the Company.

Biographies of Directors Seeking Reappointment

| David Aldrich,

The Board recruited Mr. Aldrich based on his experience in high technology signal transmission applications and for his experience as a current Chief Executive Officer of a public company. Since April 2000, he has served as President, Chief Executive Officer, and Director of Skyworks Solutions, Inc. (“Skyworks”). Skyworks is an innovator of high performance analog and mixed signal semiconductors enabling mobile connectivity.

Mr. Aldrich received a B.A. degree in political science from Providence College and an M.B.A. degree from the University of Rhode Island. | |

| Page 6 | Belden Inc. |

| Lance C. Balk,

Mr. Balk served as Senior Vice President and General Counsel of Siemens Healthcare Diagnostics from November 2007 to January 2010. From May 2006 to November 2007, he served in those positions with Dade Behring, a leading supplier of products, systems and services for clinical diagnostics, which was acquired by Siemens Healthcare Diagnostics in November 2007. Previously, he had been a partner of Kirkland & Ellis LLP since 1989, specializing in securities law and mergers and acquisitions. The Board originally recruited Mr. Balk based on his expertise in advising multinational public and private companies on complex mergers and acquisitions and corporate finance transactions. He provides insight to the Board regarding business strategy, business acquisitions, and capital structure.

Mr. Balk received a B.A. degree from Northwestern University and a J.D. degree and an M.B.A. degree from the University of Chicago. | |

| Steven W. Berglund, 62, was appointed to the Company’s Board and Compensation Committee in December 2013. The Board recruited Mr. Berglund for his experience as a current CEO of a public company and based on his extensive industrial experience, which includes complex wireless and software technology applications. Since March 1999, Mr. Berglund has served as President, Chief Executive Officer and Director of Trimble Navigation Limited (“Trimble”). Trimble is a leader in providing integrated positioning, wireless and software technology solutions that improve productivity and reduce costs for customers in various fields, including engineering and construction firms, surveying companies, and farmers and agricultural companies. He also served as a director of Verigy Ltd. until its acquisition in 2011. Prior to joining Trimble, Mr. Berglund was President of Spectra Precision, a group within Spectra Physics AB. Mr. Berglund’s business experience includes a variety of senior leadership positions with Spectra Physics, and manufacturing and planning roles at Varian Associates. He began his career as a process engineer at Eastman Kodak. Mr. Berglund attended the University of Oslo and the University of Minnesota where he received a B.S. in chemical engineering. He received his M.B.A. from the University of Rochester and is the current chair of the board of directors of the Silicon Valley Leadership Group. | |

| Judy L. Brown,

In recruiting Ms. Brown, the Board sought a member with international experience in finance and accounting to help the Company pursue its strategic global focus. As an employee of Ernst & Young for more than nine years in the U.S. and Germany, she provided audit and advisory services to U.S. and European multinational public and private companies. She served in various financial and accounting roles for six years in the U.S. and Italy with Whirlpool Corporation, a leading manufacturer and marketer of appliances. In 2004, she was appointed Vice President and Controller of Perrigo Company, a leading global healthcare supplier and the world’s largest manufacturer and marketer of over-the-counter pharmaceutical products sold under store brand labels. Since 2006, she has served as Executive Vice President and Chief Financial Officer of Perrigo.

She received a B.S. degree in Accounting from the University of Illinois; an M.B.A. from the University of Chicago; and attended the Aresty Institute of Executive Education of the Wharton School of the University of Pennsylvania. Ms. Brown also is a Certified Public Accountant. | |

| Belden Inc. 2014 Proxy Statement | Page 7 |

| Bryan C. Cressey,

For the past twenty-nine years, Mr. Cressey has been a General Partner and Principal of Golder, Thoma and Cressey, Thoma Cressey Bravo, and Cressey & Company, all private equity firms, the last of which he founded in 2007. The firms have specialized in healthcare, software and business services. He is also a director of

Mr. Cressey received a B.A. degree from the University of Washington and a J.D. degree and an M.B.A. degree from Harvard University. |

| Glenn Kalnasy,

From February 2002 through October 2003, Mr. Kalnasy served as the Chief Executive Officer and President of Elan Nutrition Inc., a private-label manufacturer of nutrition food bars. From 1982 to 2003, he was a Managing Director of The Northern Group, Inc., a private equity firm that acquired and managed businesses. Mr. Kalnasy’s extensive general management and business experience at the policy-making level, which includes being one of the founders of Cable Design Technologies (the company—now called Belden Inc.—that merged with Belden 1993 Inc. in 2004), and his long history with the Company qualify him to serve on the Board.

Mr. Kalnasy received a B.S. degree from Southern Methodist University. | |

| George Minnich,

Mr. Minnich served as Senior Vice President and Chief Financial Officer of ITT Corporation from 2005 to 2007. Prior to that, he served for twelve years in several senior finance positions at United Technologies Corporation, including Vice President and Chief Financial Officer of Otis Elevator and of Carrier Corporation. He also held various positions within Price Waterhouse from 1971 to 1993, serving as an Audit Partner from 1984 to 1993. Mr. Minnich also serves on the Board of Trustees of Albright College and is the Audit Committee Chairman and Board member of Kaman Corporation, an aerospace and industrial distribution company, and AGCO Corporation, a maker of a broad range of tractors, combines and other farm equipment. His extensive financial and accounting experience gained over 35 years plus his experience on other public company boards was important to the Board in connection with his initial election. His senior level operational background provides the Board with additional insights into multinational industrial companies.

Mr. Minnich received a B.S. degree in Accounting from Albright College. | |

| Page 8 | Belden Inc. 2014 Proxy Statement |

| John M. Monter

During his career, Mr. Monter has served in the general management position for three companies, two manufacturers and a construction services company. Previous to his general management experience, Mr. Monter worked in several marketing and sales positions, including holding worldwide responsibilities in both marketing and sales for a multinational manufacturing company. His broad general management and sales and marketing experience at the policy-making level particularly qualifies him to serve on the Company’s Board.

From 1993 to 1996, he was President of the Bussmann Division of Cooper Industries, Inc. Bussmann is a multi-national manufacturer of electrical and electronic fuses, with ten manufacturing facilities in four countries and sales offices in most major industrial markets around the world. From 1996 through 2004, he was President and Chief Executive Officer of Brand Services, Inc. (“Brand”) and also a member of the board of directors of the parent companies, Brand DLJ Holdings (1996-2002) and Brand Holdings, LLC (2002-2006). He was named Chairman of Brand DLJ Holdings in 2001 and Chairman of Brand Holdings, LLC in 2002. From January 1, 2005 through April 30, 2006, he served as Vice Chairman of Brand Holdings, LLC. Brand is a supplier of scaffolding and specialty industrial services. In 2008, he was elected a director on the board of Environmental Logistics Services, a privately held company that is owned by Centre Partners. Environmental Logistics Services is a hauler and disposer of solid wastes.

Mr. Monter received a B.S. degree in journalism from Kent State University and an M.B.A. degree from the University of Chicago. |

| John S. Stroup,

From 2000 to the date of his appointment with the Company, he was employed by Danaher Corporation, a manufacturer of professional instrumentation, industrial technologies, and tools and components. At Danaher, he initially served as Vice President, Business Development. He was promoted to President of a division of Danaher’s Motion Group and later to Group Executive of the Motion Group. Earlier, he was Vice President of Marketing and General Manager with Scientific Technologies Inc.

Mr. Stroup received a B.S. degree in mechanical engineering from Northwestern University and an M.B.A. degree from the University of California at Berkeley. Mr. Stroup is a director of RBS Global, Inc. RBS Global manufactures power transmission components, drives, conveying equipment and other related products under the Rexnord name. | ||

|

|

The Audit Committee operates under a Board-approved written charter and each member meets the independence requirements of the NYSE’s listing standards. The Committee assists the Board in overseeing the Company’s accounting and reporting practices by:by, among other items:

meeting with its financial management and independent registered public accounting firm (Ernst & Young) to review the financial statements, quarterly earnings releases, and financial data of the Company;

reviewing and selecting the independent registered public accounting firm who will audit the Company’s financial statements;

reviewing the selection of the internal auditors (Deloitte LLP) who provide internal audit services;

reviewing the scope, procedures, and results of the Company’s financial audits, internal audit procedures, and internal controls assessments and procedures under Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”);

providing oversight responsibility for the process the Company uses in performing its periodic enterprise risk analysis; and

evaluating the Company’s key financial and accounting personnel.

At its March 5, 20134, 2014 meeting, the Board determined that each of Ms. Brown and Messrs.Mr. Minnich and Yoost was an Audit Committee Financial Expert as defined in the rules pursuant to SOX and each is independent.

The Compensation Committee of Belden determines, approves, and reports to the Board on compensation for the Company’s elected officers. The Committee reviews the design, funding, and competitiveness of the Company’s retirement programs. The Committee also assists the Company in developing compensation and benefit strategies to attract, develop, and retain qualified employees. The Committee operates under a written charter approved by the Board.

The Finance Committee provides oversight in the area of corporate finance and makes recommendations to the Board about the financial aspects of the Company. Examples of topics upon which the Finance Committee may provide guidance include capital structure, capital adequacy, credit ratings, capital expenditure planning, and dividend policy and share repurchase programs. The Committee is governed by a written charter approved by the Board.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies, evaluates, and recommends nominees for the Board for each annual meeting (and to fill vacancies during interim periods); evaluates the composition, organization, and governance of the Board and its committees; oversees senior management succession planning; and develops and recommends corporate governance principles and policies applicable to the Company. The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders if such nominations are submitted to the Company prior to the deadline for proposals as noted above under the caption “Nomination of Director Candidates.”

The Committee’s responsibilities with respect to its governance function include considering matters of corporate governance and reviewing (and recommending to the Board revisions to) the Company’s corporate governance guidelines and its code of ethics, which applies to all Company employees, officers and directors. The Committee is governed by a written charter approved by the Board.

| Page 10 | Belden Inc. 2014 Proxy Statement |

Corporate Governance Documents

Current copies of the Audit, Compensation, Finance, and Nominating and Corporate Governance Committee charters, as well as the Company’s governance principles and code of ethics, are available on the Company’s website athttp://investor.belden.com/documents.cfm. Printed copies of these materials are also available to stockholders upon request, addressed to the Corporate Secretary, Belden Inc., 7733 Forsyth1 North Brentwood Boulevard, Suite 800,15th Floor, St. Louis, Missouri 63105.

Related Party Transactions and Compensation Committee Interlocks

It is our policy to review all relationships and transactions in which the company and our directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Annually, we obtain information from all directors and executive officers with respect

to related person transactions to determine, based on the facts and circumstances, whether the Company or a related person has a direct or indirect material interest in any such transaction. As required under SEC rules, transactions that are determined to be directly or indirectly material to the Company or a related person are disclosed in our proxy statement. We have determined that there were no material related party transactions during 2012.2013.

None of our executive officers served during 20122013 as a member of the board of directors or as a member of a compensation committee of any other company that has an executive officer serving as member of our Board of Directors or Compensation Committee.

The Company’s Board has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may contact any member (or all members) of the Board (including Bryan Cressey, Chairman of the Board and presiding director for non-management director meetings), any Board committee, or any chair of any such committee by U.S. mail, through calling the Company’s hotline or via e-mail.

To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Company’s Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary, Belden Inc.” at 7733 Forsyth1 North Brentwood Boulevard, Suite 800,15th Floor, St. Louis, MO 63105. To communicate with any of our directors electronically or through the Company’s hotline, stockholders should go to our corporate website athttp://investor.belden.com/documents.cfm. On this page, you will find a section titled “Contact the Belden Board”, on which are listed the Company’s hotline number (with access codes for dialing from outside the U.S.) and an e-mail address that may be used for writing an electronic message to the Board, any individual directors, or any group or committee of directors. Please follow the instructions on our website to send your message.

All communications received as set forth in the preceding paragraph will be opened by (or in the case of the hotline, initially reviewed by) our corporate ombudsman for the sole purpose of determining whether the contents represent a message to our directors. The Belden Ombudsman will not forward certain items which are unrelated to the duties and responsibilities of the Board, including: junk mail, mass mailings, product inquiries, product complaints, resumes and other forms of job inquiries, opinion surveys and polls, business solicitations, promotions of products or services, patently offensive materials, advertisements, and complaints that contain only unspecified or broad allegations of wrongdoing without appropriate information support.

In the case of communications to the Board or any group or committee of directors, the corporate ombudsman’s office will send copies of the contents to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

In addition, it is the Company’s policy that each director attends the annual meeting absent exceptional circumstances. Each director other than Mr. CresseyYoost attended the Company’s 20122013 annual meeting.

| Belden Inc. 2014 Proxy Statement | Page 11 |

Board Leadership Structure and Role in Risk Oversight

For some time, the Company has separated the Chief Executive Officer and Board Chairman positions. We believe this separation of roles is most appropriate for the Company and stockholders. Mr. Cressey, who is independent of management and the Company, provides strong leadership experience, strategic vision, and an understanding of the risks associated with our business. Mr. Stroup, as CEO, provides strategic planning, general management experience, and in-depth knowledge of the Company, and, as a member of the Board, acts as an important liaison between management and the Company’s non-employee directors.

Our Board assesses on an ongoing basis the risks faced by the Company in executing its strategic plan. These risks include strategic, technological, competitive, and operational risks. The Audit Committee oversees the

process we use in performing our annual enterprise risk management (“ERM”) analysis (while the Board oversees the content of the analysis, management is responsible for the execution of the process and the development of the content).

Director Stock Ownership Policy

The Board’s policy requires that each non-employee director hold Company stock equal in value to five times his or her annual cash retainer (currently 5 times $65,000)$68,000). Upon appointment, a member has five years to meet this requirement, but must meet interim goals during the five-year period of: 20% after one year; 40% after two years; 60% after three years; and 80% after four years. The in-the-money value of vested stock options and the value of unvested RSUs are included in making this determination at the higher of their grant date value or current market value. Each non-employee director meets either the full-period or interim-period holding requirement: Ms. Brown and Messrs. Aldrich, Balk, Cressey, Kalnasy Monter and RethoreMonter each meet 100% of the stock holding requirement. Mr. Minnich, who was appointed in May 2010, and Mr. Yoost, who was appointed in March 2011, each meet the two-yearthree-year interim requirement. Mr. Berglund, who was appointed in December 2013 does not yet have an interim requirement.

Each non-employeeThe following table reflects the director receives a $65,000 annual cash retainer; a time-vested (twelve month) annual restricted share unit (“RSU”) awardcompensation structure as of $120,000 dividedDecember 31, 2013 and as of May 1, 2014 per changes approved by the then-current share price;Board at its December 2013 meeting:

| Description | As of December 31, 2013 ($) | As of May 1, 2014 ($) | Recipient(s) | |||

Cash Components | ||||||

| Basic Retainer | 68,000 | 71,000 | All except Stroup | |||

| Audit Committee Chair | 11,000 | 11,500 | Minnich | |||

| Other Committee Chair | 5,800 | 6,000 | Balk, Kalnasy and Monter | |||

| Audit Committee Service | 5,800 | 6,000 | Brown, Minnich and Yoost | |||

| Multiple Committee Service | 5,800 | 6,000 | Balk, Brown, Cressey and Monter | |||

| Non-Executive Chair | 37,500 | 39,000 | Cressey | |||

| Equity Components | ||||||

| Restricted Stock Unit Grant | 126,000 | 131,000 | All except Stroup | |||

| Additional Grant for Non-Executive Chair | 37,500 | 39,000 | Cressey | |||

| Page 12 | Belden Inc. 2014 Proxy Statement |

In 2013, the Board, guided by industry data, approved an additional $10,500increase in compensation for the non-executive chair position, retroactive to January 1, 2012, of $75,000 per year, forhalf of which was to be paid in cash and half of which was to be included in the chairannual equity grant. As illustrated above, this aggregate amount will increase to $78,000 as of the Audit Committee; an additional $5,500 per year to the chairs of the Compensation, Finance and Nominating and Corporate Governance Committees; an additional $5,500 per year to members of the Audit Committee and members of other committees who serve on more than one committee; and upon appointment, a non-employee director receives a time-vested RSU award of 2,500 shares, which vests equally over three years. At its March 2013 meeting, the Board approved increasing the compensation categories as follows, with such changes to take effect on May 1, 2013: annual cash retainer – $68,000; annual RSU grant – $126,000; audit committee chair – $11,000; other committee chairs – $5,800; and multiple committee chairs – $5,800.2014.

The following table provides information on non-employee director compensation for 2012.2013.

| Director | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | Option Awards(3) ($) | All Other Compensation(4) ($) | Total ($) | Fees Earned or ($) | Stock Awards(2) ($) | Option Awards(3) ($) | All Other Compensation(4) ($) | Total ($) | ||||||||||

David Aldrich | 63,333 | 120,000 | - | 622 | 183,955 | 67,000 | 125,982 | - | 768 | 193,750 | ||||||||||

Lance C. Balk | 74,000 | 120,000 | - | 11,991 | 205,991 | 78,400 | 125,982 | - | 12,506 | 216,888 | ||||||||||

Steven W. Berglund | 5,667 | 170,250 | - | - | 175,917 | |||||||||||||||

Judy L. Brown | 74,000 | 120,000 | - | 622 | 194,622 | 78,400 | 125,982 | - | 768 | 205,150 | ||||||||||

Bryan C. Cressey | 68,667 | 120,000 | - | 622 | 189,289 | 147,700 | 201,025 | - | 768 | 349,493 | ||||||||||

Glenn Kalnasy | 68,667 | 120,000 | - | 622 | 189,289 | 72,700 | 125,982 | - | 768 | 199,450 | ||||||||||

Mary S. McLeod | 25,417 | 119,995 | - | 622 | 146,034 | |||||||||||||||

George Minnich | 79,000 | 120,000 | - | 333 | 199,333 | 83,533 | 125,982 | - | 500 | 210,015 | ||||||||||

John M. Monter | 74,000 | 120,000 | - | 622 | 194,622 | 78,400 | 125,982 | - | 768 | 205,150 | ||||||||||

Bernard G. Rethore | 27,542 | 119,995 | - | 4,122 | 151,659 | |||||||||||||||

Dean Yoost | 68,667 | 120,000 | - | 789 | 189,456 | 72,700 | 125,982 | - | 1,101 | 199,783 | ||||||||||

| (1) | Amount of cash retainer and committee fees. |

| (2) | As required by the instructions for completing this column “Stock Awards,” amounts shown are the grant date fair value of stock awards granted during |

| the Company’s Annual Report on Form 10-K for the year ended December 31, |

| (3) |

| ||

| ||

| ||

|

| (4) | Amount of interest earned on deferred director fees and dividends paid on vested stock awards. |

ITEM I – ELECTION OF NINE DIRECTORS

The Company has nineten directors – Ms. Brown and Messrs. Aldrich, Balk, Berglund, Cressey, Kalnasy, Minnich, Monter, Stroup and Yoost. The term of each director will expire at this annual meeting and the Board proposes that each of them (other than Mr. Yoost who will not stand for reelection) be reelected for a new term of one year and until their successors are duly elected and qualified. Each nominee has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE NOMINATED SLATE OF DIRECTORS.

| Belden Inc. 2014 Proxy Statement | Page 13 |

PUBLIC ACCOUNTING FIRM INFORMATION

ITEM II – RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 20132014

The Audit Committee has selectedIt is anticipated that Ernst & Young LLP will be selected as our independent registered public accounting firm for the year ending December 31, 2013,2014, and the Board of Directors has directed that management submit the anticipated appointment for ratification by the stockholders at the annual meeting. Ernst & Young has served as our registered public accounting firm since the 2004 merger of Belden Inc. and Cable Design Technologies Corporation, and prior to that served as Belden 1993 Inc.’s registered public accounting firm since it became a public company in 1993. A representative of the firm will be present at the annual meeting, will have an opportunity to make a statement, if they desire, and will be available to respond to appropriate questions.

We are not required to obtain stockholder ratification of the appointment of Ernst & Young as our independent registered public accounting firm. However, we are submitting the appointment to stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit Committee will reconsider whether or not to retain Ernst & Young. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time if they determine that such a change would be in our best interests and the best interests of our stockholders.

Fees to Independent Registered Public Accountants for 20122013 and 20112012

The following table presents fees for professional services rendered by EY for the audit of the Company’s annual financial statements and internal control over financial reporting for 20122013 and 20112012 as well as other permissible audit-related and tax services.

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

Audit Fees | $ | 2,691,710 | $ | 2,285,895 | $ | 2,633,723 | $ | 2,691,710 | ||||||||

Audit-Related Fees | 475,082 | 367,566 | 265,349 | 475,082 | ||||||||||||

Tax Fees | 623,966 | 194,448 | 1,187,534 | 623,966 | ||||||||||||

All Other Fees | 0 | 0 | 0 | 0 | ||||||||||||

Total EY fees | $ | 3,790,758 | $ | 2,847,909 | $ | 4,086,606 | $ | 3,790,758 | ||||||||

“Audit fees” primarily represent amounts paid or expected to be paid for audits of the Company’s financial statements and internal control over financial reporting under SOX 404, review of SEC comment letters, reviews of SEC Forms 10-Q, Form S-8, Form 10-K and the proxy statement, and statutory audit requirements at certain non-U.S. locations.

“Audit-related fees” are primarily related to due diligence services on completed and potential acquisitions.

“Tax fees” for 20122013 and 20112012 are for domestic and international compliance totaling $95,053$132,746 and $58,112,$95,053, respectively, and tax planning totaling $528,913$1,054,788 and $136,336,$528,913, respectively.

In approving such services, the Audit Committee did not rely on the pre-approval waiver provisions of the applicable rules of the SEC.

Audit Committee’s Pre-Approval Policies and Procedures

Audit Fees:For 2012,2013, the Committee reviewed and pre-approved the audit services and estimated fees for the year. Throughout the year, the Committee received project updates and, if appropriate, approved or ratified any amounts exceeding the original estimates.

| Page 14 | Belden Inc. 2014 Proxy Statement |

Audit-Related and Non-Audit Services and Fees:Annually, and otherwise as necessary, the Committee reviews and pre-approves all audit-related and non-audit services and the estimated fees for such services. For recurring services, such as tax compliance and statutory filings, the Committee reviews and pre-approves the services and estimated total fees for such matters by category and location of service. The projected fees are updated quarterly and the Committee considers and, if appropriate, approves any amounts exceeding the original estimates.

For non-recurring services, such as special tax projects, due diligence, or other tax services, the Committee reviews and pre-approves the services and estimated fees by individual project. Up to an approved threshold amount, the Committee has delegated approval authority to the Committee Chair. The cost projections are updated quarterly and the Committee reviews, and, if appropriate, approves any amounts exceeding the original estimates.

Should an engagement need pre-approval before the next Committee meeting, the Committee has delegated to the Committee Chair (or if he were unavailable, another Committee member) authority to grant such approval.approval up to an approved spending threshold. Thereafter, the entire Committee will review such approval at its next quarterly meeting.

The Audit Committee assists the Board in overseeing various matters, including: (i) the integrity of the Company’s financial statements; (ii) all material aspects of the Company’s financial reporting, internal accounting control, and audit functions; (iii) the qualifications and independence of the independent auditors; and (iv) the performance of the Company’s internal audit function and independent auditors.

The Audit Committee’s oversight includes reviewing with management the Company’s major financial risk exposures and the steps management has taken to monitor, mitigate, and control such exposures. Management has the responsibility for the implementation of these activities and is responsible for the Company’s internal controls, financial reporting process, compliance with laws and regulations, and the preparation and presentation of the Company’s financial statements.

Ernst & Young LLP (“EY”), the Company’s registered public accounting firm for 2012,2013, is responsible for performing an independent audit of the consolidated financial statements and an audit of the effectiveness of the Company’s internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (U.S.) (“PCAOB”) and issuing reports with respect to these matters, including expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles.

In connection with the Company’s December 31, 20122013 financial statements, the Committee: (i) has reviewed and discussed the audited financial statements with management (including management’s assessment of the effectiveness of the Company’s internal control over financial reporting and EY’s audit of the Company’s internal control over financial reporting for 2012)2013); (ii) has discussed with EY the matters required to be discussed under current auditing standards; and (iii) has received and discussed with EY the written disclosures and letter from EY required by the PCAOB Ethics and Independence Rule 3526,Communication with Audit Committees Concerning Independence, and has discussed with EY their independence from the Company.

As part of such discussions, the Committee has considered whether the provision of services provided by EY, not related to the audit of the consolidated financial statements and internal control over financial reporting referred to above or to the reviews of the interim consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, is compatible with maintaining EY’s independence. (Above is a report on audit fees, audit-related fees and tax fees the Company paid EY for services performed in 20122013 and 2011.2012.) The Committee has concluded that EY’s provision of non-audit services to the Company and its subsidiaries is compatible with their independence.

| Belden Inc. 2014 Proxy Statement | Page 15 |

Based on these reviews and discussions, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for 2012.2013.

Audit Committee

George Minnich (Chair)

Judy L. Brown

Dean Yoost

THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

RATIFICATION OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED

ACCOUNTING FIRM.

EQUITY COMPENSATION PLAN INFORMATION ON DECEMBER 31, 20122013

| Plan Category | A | B | C | A | B | C | ||||||||||||||||||||||||||||||||||

Number of Securities to be Issued Upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A) | Number of Securities to be Issued Upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A) | |||||||||||||||||||||||||||||||||||

Equity Compensation Plans Approved by Stockholders(1) | 2,843,682 | (2 | ) | 31.4863 | 3,425,213.40 | (3 | ) | 1,667,880 | (2 | ) | 36.3784 | 3,006,911.50 | (3 | ) | ||||||||||||||||||||||||||

Equity Compensation Plans Not Approved by Stockholders | 295,091 | (5 | ) | 19.9300 | 0 | - | - | - | ||||||||||||||||||||||||||||||||

Total | 3,138,773 | 3,425,213.40 | 1,667,880 | 3,006,911.50 | ||||||||||||||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||||||||||

| (1) | Consists of the Belden Inc. 2003 Long-Term Incentive Plan (the “2003 Plan”); the Cable Design Technologies Corporation 2001 Long-Term Performance Incentive Plan (the “2001 Plan”); and the Belden Inc. 2011 Long Term Incentive Plan (the “2011 Plan”). The 2001 Plan has expired, but stock option and restricted stock awards remain outstanding under these plans. No further awards can be issued under the 2003 Plan. |

| (2) | Consists of |

| (3) | Consists of |

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of filings with the Securities and Exchange Commission and other reports submitted by our directors and officers, we believe that all of our directors and executive officers complied during 20122013 with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, with two exceptions. In January 2013, we discovered some discrepancies between our records and those of Glenn Kalnasy. We were unable to identify the root cause of the discrepancy but determined that it pre-dated the 2004 merger of Belden Inc. and Cable Design Technologies. On January 2, 2013, we filed a corrective Form 4 to match the public record with reality. On February 19, 2013, an account reconciliation for Denis Suggs led to the discovery that a Form 4 was not filed when the vesting of restricted stock units on June 11, 2012 led to the forfeiture of 2,165 shares of common stock previously reported as beneficially owned. This correction was reported on a Form 4 filed on February 19, 2013.1934.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of Belden common stock beneficially owned (unless otherwise indicated) by our directors, the executive officers named in theSummary Compensation Table below and the directors and executive officers as a group. Except as otherwise noted, all information is as of April 4, 2013.2014.

BENEFICIAL OWNERSHIP TABLE OF DIRECTORS, NOMINEES AND

EXECUTIVE OFFICERS

| Name | Number of Shares Beneficially Owned(1)(2) | Acquirable Within 60 Days(3) | Percent of Class Outstanding(4) | Number of Shares Beneficially Owned(1)(2) | Acquirable Within 60 Days(3) | Percent of Class Outstanding(4) | ||||||||||||||||||

David Aldrich | 25,368 | - | * | 27,725 | - | * | ||||||||||||||||||

Lance Balk | 76,972 | - | * | 79,329 | - | * | ||||||||||||||||||

Steve Biegacki | 15,149 | 74,961 | * | |||||||||||||||||||||

Steven W. Berglund | 2,500 | - | * | |||||||||||||||||||||

Kevin Bloomfield | 15,168 | 104,188 | * | |||||||||||||||||||||

Judy L. Brown | 23,335 | - | * | 25,692 | - | * | ||||||||||||||||||

Bryan C. Cressey | 153,521 | - | * | 157,282 | - | * | ||||||||||||||||||

Henk Derksen | 7,507 | 41,960 | * | 14,557 | 59,752 | * | ||||||||||||||||||

Christoph Gusenleitner | 8,900 | 35,820 | * | 11,704 | 29,568 | * | ||||||||||||||||||

Glenn Kalnasy | 28,751 | 3,000 | * | 31,108 | 1,000 | * | ||||||||||||||||||

George Minnich | 14,100 | - | * | 16,457 | - | * | ||||||||||||||||||

John M. Monter(5) | 93,463 | - | * | |||||||||||||||||||||

John M. Monter(5) | 80,220 | - | * | |||||||||||||||||||||

John Stroup | 144,796 | (6) | 988,784 | (7) | * | 168,130 | (6) | 334,806 | (7) | * | ||||||||||||||

Denis Suggs | 17,519 | 102,662 | * | |||||||||||||||||||||

Dhrupad Trivedi | 7,436 | 4,045 | * | |||||||||||||||||||||

Dean Yoost | 11,402 | - | * | 14,970 | - | * | ||||||||||||||||||

| All directors and executive officers as a group (17 persons) | 683,460 | 1,400,919 | 1.17 | % | ||||||||||||||||||||

| All directors and executive officers as a group (18 persons) | 694,700 | 653,961 | 1.16 | % | ||||||||||||||||||||

| * | Less than one percent |

| (1) | The number of shares includes shares that are individually or jointly owned, as well as shares over which the individual has either sole or shared investment or voting authority. Mr. Cressey’s number does not include shares held by the Bryan and Christina Cressey Foundation. Mr. Cressey is the President of the foundation but disclaims any beneficial ownership of shares owned by the foundation. |

| (2) | The number of shares shown for |

| Page 18 | Belden Inc. 2014 Proxy Statement |

| (3) | Reflects the number of shares that could be purchased by exercise of stock options and the number of SARs that are exercisable at April 4, |

| price of Belden shares on the date of exercise and the exercise price paid in the form of Belden shares. This column includes stock options and SARs that are exercisable without regard to whether the current market price of Belden common stock is greater than the applicable exercise price. |

| (4) | Represents the total of the “Number of Shares Beneficially Owned” column (excluding RSUs, which do not have voting rights before vesting) divided by the number of shares outstanding at April 4, |

| (5) | Includes |

| (6) | Includes 4,063 shares held in trust for children and 86,555 shares held in a family trust. |

| (7) | Includes |

BENEFICIAL OWNERSHIP TABLE OF STOCKHOLDERS OWNING MORE THAN FIVE PERCENT

The following table shows information regarding those stockholders known to the Company to beneficially own more than 5% of the outstanding Belden shares as of December 31, 2012.2013.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Outstanding Common Stock(1) | ||||||

Wellington Management Company, LLP 280 Congress Street Boston, Massachusetts 02210 | 4,729,537 | (2) | 10.88 | % | ||||

BlackRock, Inc. 40 East 52nd Street New York, New York 10022 | % | |||||||

| % | |||||||

Invesco Ltd. Invesco Advisers, Inc.

Invesco PowerShares Capital Management Invesco National Trust Company (collectively, the “Invesco Group”) 1555 Peachtree Street NE Atlanta, Georgia 30309 | ||||||||

| (5) | |||||||

| % | |||||||

| (1) | Based on |

| (2) |

| Information based on Schedule 13G/A filed with the SEC by Wellington Management Company, LLP on February 14, |

| (3) | Information based on Schedule 13G/A filed with the SEC by BlackRock, Inc. on January 28, 2014, reporting sole voting power over 3,778,742 shares and sole dispositive power over 3,912,781 shares. |

| (4) | Information based on Schedule 13G filed with the SEC by the Vanguard Group on February 11, 2014, reporting sole voting power over 62,243 shares, sole dispositive power over 2,580,376 and shared dispositive power over 59,643 shares. |

| (5) | Information based on Schedule 13G filed with the SEC by the Invesco Group on February 4, 2014, reporting sole voting power over 2,192,369 shares and sole dispositive power over 2,261,084 shares. |

Compensation Discussion and Analysis (“CD&A”)

A NOTEFROMTHE BELDEN COMPENSATION COMMITTEE

Valued Belden Stockholders:

The Committee would like to thank Belden’s stockholders for theiranother year of loyal support in 2012. The fact that2013. For the second consecutive year, our Say-on-Pay proposal was supported by over 97% of the voted shares meansshares. This illustrates to us that: (1) the stockholders understand and support the Company’s strategy, (2) the stockholders believe in the management team and agree that the compensation structure is well aligned with Company performancestrategy and (3) that there is an open line of communication between management and stockholders. ThisContinuous engagement with the investment community was better than ever in 2012is a top priority for Belden management and our Say-on-Pay support signals to us that management is a testament to strong executionexecuting well on this priority.

20122013 was an excitingimportant year of transition at Belden. InThe integration of two major 2012 acquisitions coupled with the transition to a challenging environment for economic growth,new operating platform structure required strong leadership. The fact that the Company executed four major inorganic actionsbalanced these changes with strong execution in the second halfmarketplace is a testament to the team that John Stroup has assembled and the business systems they have put in place over the past eight years. The investment community’s endorsement of the yearstrategy and performance are reflected in valuations not previously seen at Belden, and we strive to completebuild upon the transformation from a wiretrust provided by current and cable manufacturer to a global signal transmission solutions provider. 2013 will begin a new chapter for the Company and will provide expanded opportunities for value creation.prospective stockholders.

We reaffirm our primary dutyunderstand, however, that successful times can test a compensation program as much as challenging times. We are acutely aware that as the equity prices increase, we need to ensure that the Company is doing what is inour management remains properly engaged and motivated. We believe that the long term best interestsfocus of Belden stockholders. As Belden begins this new era, weincentive programs will remain activebe successful in ensuring thatmotivating our leaders to drive even more value creation well into the Company’s compensation programs are consistent with the Belden value of continuous improvement.future. We hope that after reviewing the materials that follow, you will continue to agree that we are doing our job of aligning pay with performance.

Therefore, we request your support for Belden’s Say-on-Pay proposal this year. If at any time you would like to discuss the compensation program, Belden management is available to address your questions. Thank you for your consideration.

The Belden Inc. Compensation Committee

GLENN KALNASY, CHAIR | DAVID ALDRICH | STEVEN W. BERGLUND | JOHN MONTER |

In this section, we discuss our compensation program as it pertains to our chief executive officer, our chief financial officer, and our three other most highly compensated executive officers who were serving at the end of 2012.2013. We refer to these five persons throughout as the “named executive officers” or our “NEOs.”

For 2012,2013, our named executive officers were:

John Stroup | President and Chief Executive Officer | |

Henk Derksen | Senior Vice President, Finance, and Chief Financial Officer | |

| Senior Vice President, | |

Christoph Gusenleitner | Executive Vice President, | |

| Executive Vice President, |

2012 was a tale of two halves for Belden. We entered the year challenged by slow growth in the developed economies, continuing instability in Europe and a hypercompetitive M&A market. The business functioned well in the first half despite the headwinds, but we were clearly not satisfied. While equally challenging, the second

half brought fresh opportunities. In July, we acquiredII. Executive Summary

As noted by our Compensation Committee above, 2013 was an exciting year at Belden. 2012 closed with four second-half M&A transactions and plans to transition into a new reporting structure in 2013. The acquisitions of Miranda Technologies a world leader in broadcast infrastructure solutions. In December, we acquiredand PPC Broadband a global leader in broadband connectivity. These acquisitions, along with our Telecast Fiber division, give Beldenwere integrated successfully and at the most comprehensive portfoliobeginning of broadcast solutions, from audio and video content creation, capture and aggregation, through delivery and playout, whether it be on tablets and other mobile devices or through high-definition televisions displaying traditional cable and satellite signals. Additionally, prior to year-end,April we were able to execute on the strategic divestitures of the Thermax/Raydex aerospace and defense unit and of our consumer electronics assets in China. Some other financial highlights included:

A total stockholder return for 2012 of 35.9%.

A restructuring of our long-term debt, effectively replacing $550 million of notes, with an average interest rate of approximately 7.8%, with $700 million of 5.5% notes maturing in 2022.

The repurchase of $75 million of Belden stock at an average price of $36.20, or 25.5% below our record date closing price of $48.61 per share.

As we exited 2012, despite a continued environment of slow growth in many countries and the U.S. political instability caused by the “fiscal cliff” debate, our acceleration of inorganic activities completed the transformation on which we embarked in 2005, and positioned Belden strongly for the next phase, the evolution of the business intobegan reporting results as four distinct global business platforms: Industrial Connectivity Solutions, Industrial IT Solutions, Enterprise Connectivity Solutions and Broadcast Solutions. Some financial highlights of the consolidated business included:

A total stockholder return for 2013 of 57.1%.

Over a 12% increase in revenues, both on a GAAP and an adjusted basis.

The distribution of over $100 million to stockholders in the form of dividends and our share repurchase program.

The Company’s 20122013 overall financial results and the individual performance of our NEOs are discussed underAnnual Cash Incentive Plan Awards beginning on page 26.27.

Some of the compensation-related highlights since our last proxy statement include:

Continued economic uncertainty led to the decision to utilizeThe Company again employed two six-month periods for the establishment of performance targets under our annual cash incentive program (“ACIP”). This allowed management to set second half targets that kept our associates properly incentivized to deliver a solid close to the year.

| • | Consistent with the transformation of the product portfolio, S&P reclassified the Company’s Global Industry Classification Standard (GICS®) code from the Capital Goods industry to the Technology Hardware & Equipment industry. |

As discussed previously, in 2010, in order to encourage retention, we awarded each eligible participant inUnder this new GICS code, the long term incentive program (“LTIP”) aCompany’s three-year grant of restricted stock units (“RSUs”), 50% of which would vest in three years, 25% in four years and 25% in five years. Therefore, these participants did not receive annual RSU grants in 2011 and 2012 unless they were promoted within the organization. Two NEOs received a 2012 RSU grant, one in recognition of a promotion and one as a long term retention tool. Another year without widespread RSU grants allowed our 2012average equity award burn rate to be 1.62%, lowering our three-year averageof 1.52% is far below the 5.49% burn rate to 2.32%, well within the guidelines for our industry groupcap established by Institutional Shareholder Services Inc. (“ISS”).

In our continual efforts to employ best practices, the Compensation Committee implemented the following changes to the compensation program:

| o |

| o | Starting in |

| o | Also starting in |

These new features enhanced a compensation program, which already had the following stockholder-friendly components:

No tax gross-ups on perquisites and no change-in-control-related excise tax gross-ups in employment agreements entered into in or after 2010.

Double trigger change-in-control severance provisions in employment agreements.

No history of option repricing or cash buyouts of underwater options.

Equity plans do not have evergreen share authorizations and do not allow for aggressive share recycling.

Robust director and officer ownership guidelines, including six times annual base salary for the Chief Executive Officer.

No guaranteed ACIP or LTIP awards for officers. Both plans also contain award caps.

| Page 22 | Belden Inc. 2014 Proxy Statement |

III. 20122013 Say-on-Pay Review

As discussed inFor the second consecutive year, our 2012 proxy statement, the approval rateexecutive compensation program was endorsed by a vast majority of less than 70% for our first say-on-pay proposal in 2011 led to an unprecedented level of outreach to stockholders and the major stockholder advisory firms. This engagement effort was overwhelmingly successful.stockholders. With 94.06%94.58% of our shares voting on the issue, we received 97.54%97.77% in favor of the proposal, with only 1.01%0.56% opposing and 1.45%1.67% abstaining.

While clearly a positive outcome, we will not rest. We will continue to engage with stockholders on this important issue and are available to answer any questions or discuss any concerns leading up to our Annual Meeting. If you would like to discuss these matters with management, please feel free to reach out to us as described on page 1.

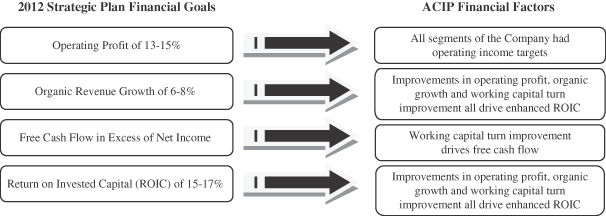

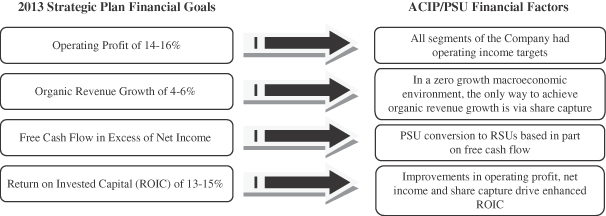

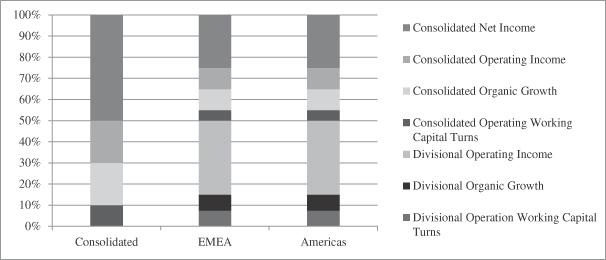

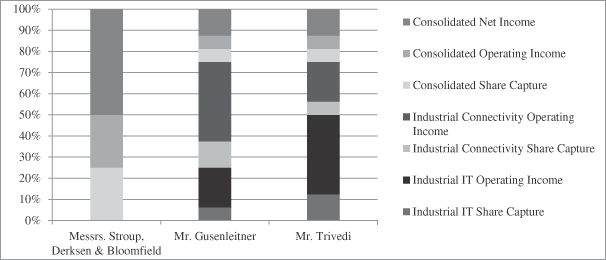

IV. Compensation Objectives and Elements

Belden’s executive compensation program is designed to support the interests of stockholders by rewarding executives for achievement of the Company’s specific business objectives, which in 20122013 were net income from continuing operations, operating income operating working capital turns and organic growth.share capture. The overarching principles of the program are:

Maximizing stockholder value by allocating a significant percentage of compensation to performance-based pay that is dependent upon achievement of the Company’s performance goals, without encouraging excessive or unnecessary risk taking.

Aligning executives’ interests with stockholder interests by providing significant stock-based compensation and expecting executives to hold the stock they earn in compliance with our ownership guidelines.

Attracting and retaining talented executives by providing competitive compensation opportunities.

Rewarding overall corporate results while recognizing individual contributions.

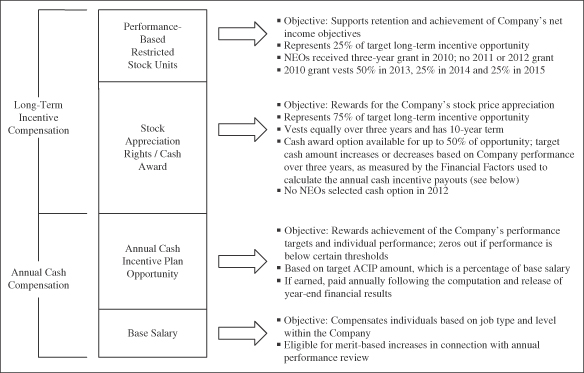

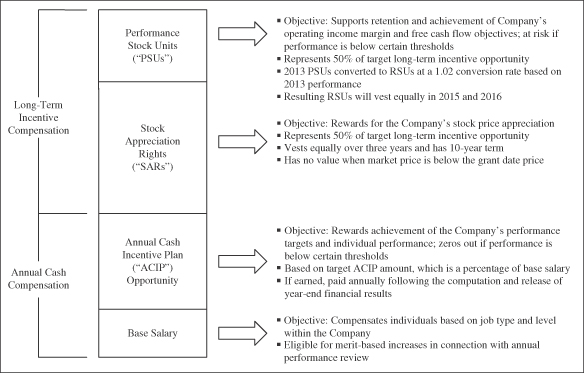

Below is an illustration of Belden’s compensation program. Individual compensation packages and the mix of base salary, annual cash incentive opportunity and long-term equity incentive compensation for each NEO varies depending upon the executive’s level of responsibilities, potential, performance and tenure with the Company. Each of the elements shown below is designed for a specific purpose, with the overall goal of achieving a high and sustainable level of Company and individual performance. The percentage of total compensation that is performance-based and therefore at risk generally increases as an officer’s level of responsibilities increases. Approximately 73%83% of Mr. Stroup’s 20122013 compensation was performance-based compensation.compensation, up from 73% for 2012. The chart below is not to scale for any particular named executive officer.

Additionally, the Company provides competitive retirement and benefit programs to our NEOs on the same basis as other employees and limited perquisites as described underCompensation Policies and Other Considerations.

C. Pay for Performance Philosophy

OneOur ability to execute on our strategic plan relies on implementation of Belden’s main strategic priorities is our talent management program. We continually seek to hire and retain high performing and high potential managers to both drive performance today and build a dependable bench of successors for the future. This philosophy includes both compensating these managers well when we achieve our performance goals as well as placing large portions of management compensation at risk if the Company underperforms.

We believe that this philosophy has provided an appropriate balance to drive continuous improvement while retaining high performers through challenging times. More importantly, we believe the incentives we provide for achievement without rewarding under-performance aligns the interests of our managers closely with those of our investors, which is the main objective.

Role of Compensation Consultant

TheFollowing an analysis based on rules promulgated by the NYSE, the Compensation Committee has retained Deloitte Consulting LLP (“Deloitte”) as its independent compensation consultant. Deloitte reports directly to the Committee. The Committee generally relies on Deloitte to provide it with comparison group benchmarking data and information as to market practices and trends, and to provide advice on key Committee decisions.

In 2012,2013, Deloitte provided advice to the Compensation Committee and management in connection with a proposed new long-term incentive compensation program, the composition of peer companies we use for benchmarking purposes, the design of our annual cash incentive and long-term incentive programs, and our executive employment agreements. For their compensation consulting in 2012,2013, we paid Deloitte $164,462.$178,084.

In 2012,2013, our financial management engaged Deloitte to perform other services involving internal controls auditing, tax consulting and acquisition due diligence. For these non-compensation related services, we paid Deloitte $1,536,414.$1,595,001. The Compensation Committee did not approve these charges prior to their incurrence, but considered them in connection with Deloitte’s retention for 2013.2014. Given the nature and scope of these other services, the Compensation Committee does not believe this work had any impact on the independence of our independent consultant.

Benchmarking and Survey Data

In determining total compensation levels for our NEOs, the Compensation Committee reviews market trends in executive compensation and a competitive analysis prepared by Deloitte, which compares our executive compensation to both the companies in the comparator group described below and to broader market survey data. The Committee also considers other available market survey data on executive compensation philosophy, strategy and design. The Company’s compensation philosophy is to target base salaries at the 50th percentile of the competitive market. As discussed above, at-risk incentive compensation components have the potential to reward our executives at levels above industry medians, but only when the Company is outperforming the industry.

The Committee chose our comparator group from companies in the primary industry segments in which the Company operates that had similar annual revenues and market capitalizations.competes for talent.

The comparator group companies for 20122013 were as follows:

Acuity Brands, Inc. | ||||

Amphenol Corporation | General Cable Corporation | Molex Incorporated | ||

Anixter International Inc. | Regal Beloit Corporation | |||

A.O. Smith Corporation | Roper Industries, Inc. | |||

Carlisle Companies Incorporated | ||||

| Wesco International, Inc. |

A prior member of the comparator group, Thomas & Betts Corporation, was acquired early in 2012 and thus dropped out of the group. Pentair, Inc.Molex Incorporated was acquired at the end of 20122013 and will not be in the comparator group for 2013. At its March 2013 meeting, the Committee approved the addition2014.

ISS and Glass-Lewis now both independently develop and publish peer groups that they use to analyze our compensation. It is noteworthy that of the following15 companies to thein our comparator group, for 2013: Amphenol Corporation, Curtiss-Wright Corporation and Wesco International, Inc.

13 were chosen by ISS, Glass-Lewis, or both, as appropriate peer companies. The Committee considers the comparator group competitive pay analysis and survey data as a frame of referencesimply non-determinative data points in making its pay decisions. The approach to pay decisions is not formulaic and the Committee, based on advice from Deloitte, exercises judgment in making them.

| Belden Inc. 2014 Proxy Statement | Page 25 |

Each year, the Committee reviews the performance evaluations and pay recommendations for the named executive officers and the other senior executives. The Compensation Committee, with input from the Board, meets in executive session without the CEO present to review the CEO’s performance and set his compensation.

In its most recent review in March 2013,2014, the Committee concluded that the total direct compensation of executive officers, with respect to compensation levels, as well as structure, remained consistent with our compensation design and objectives.

V. 20122013 Compensation Analysis